Most businesses are focused on acquiring new customers. But what about retaining existing customers? The rate of customer loss, or your churn rate, is how companies keep track of customer retention. As Dan Schoenbaum, COO or RiskIQ explains, even a five percent monthly churn rate, compounded annually, could amount to a loss of almost half your customers.

Fortunately, artificial intelligence and machine learning can help enterprises like yours predict and prevent customer churn in new ways. AI gives you the ability to process large amounts of internal and external data to not only predict if a customer will churn, but also when a customer will churn.

AI models that predict customer churn

We’ve all heard about the importance of AI in today's advanced analytics environment. But how can AI be leveraged to predict customer churn? AI is improving the cognitive ability of machines and enabling us to make significant changes in the way we make business decisions. In addition to predicting the if and when of customer churn, AI allows us to analyze a broad array of ‘signals’ or data points that give deeper and more accurate insights into potential churn. Here are a few examples:

- Survival analysis: Shows the probability of an event occurring past a given time. For example, survival analysis could help predict when a customer will make a purchase after adding a product to their cart

- Custom loss functions: Tests how accurate a model is in predicting the actual outcomes. A custom loss function can be applied to a recurrent neural network (RNN) in a way that can learn survival analysis

- AI data output: Predicts the likelihood of a consumer making a purchase in the future (or how unlikely from the viewpoint of a lapsed consumer) using a probability distribution

AI in action: the RNN model

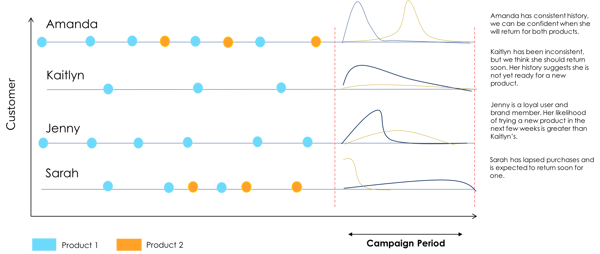

An Antuit client, a leading aesthetics brand, needed to to identify when to re-engage customers to prevent customer churn. Leveraging the RNN model, Antuit created a state of the art and personalized loyalty program that incorporated:

- A real-time lapsed model to identify when to re-engage customers to prevent customer loss

- A real-time acquisition model to identify when to engage customers with cross-sales to drive growth

- Lifetime value models to understand how much to invest in customer engagement at a 1:1 level

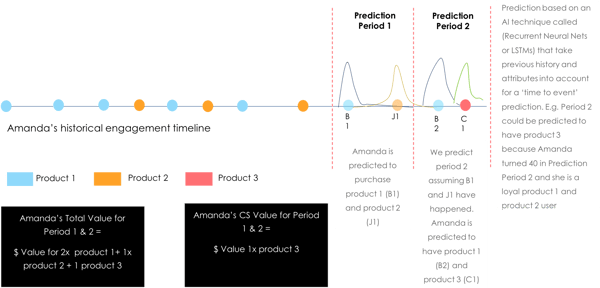

Specifically, we used artificial intelligence to build long-term cross-brand customer life-time value (CLTV).

Gathering & transforming data

After gathering demographic (age, gender, ethnicity, income levels, and interests) and engagement (what quantity of product was purchased and when) data, we were able to predict when a customer would next use a product. In addition, the model was able to learn when a customer would purchase a product based on cross-product usage.

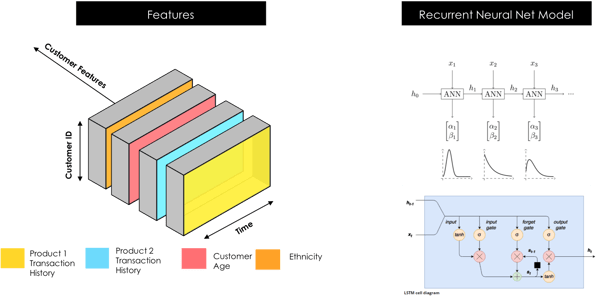

The AI model we deployed required uniformly spaced time intervals with customer features / product engagement information at each step.

To reshape data from tabular (transactional) to an n-dimensional array (AI input) a data pipeline was built. The data pipeline ingests transaction data as well as customer demographic data, appropriately fills time steps according to customer engagement, and fills time steps with the customer’s age corresponding to each time step.

Creating ‘time to event’ predictions

The AI model’s objective was designed to predict the timing of customer engagement. We wanted to predict when a customer is likely to lapse.

Many AI models are designed with different tasks in mind. The objective of this model is key to what type of predictions will be generated. For example, in predictive text, what is the next likely word? For our model we specified an objective centered around timing to the next transaction.

From predicting customer churn to improving customer experience

The benefits of using artificial intelligence go beyond predicting customer churn. AI can help enterprises improve customer experience, specifically through the following:

Reducing analysis time

AI sifts through huge amounts of customer data to identify variables that predict customer churn. This gives you the information needed to determine which customers are most likely to churn and which intervening actions should be taken. By eliminating the time needed to analyze data, enterprises can act faster (and smarter) to retain customers.

Improving content personalization

AI can analyze previous customer behavior to personalize future content such as emails and offers recommending more relevant products. Since each message is tailored to the individual, you can expect to see higher conversion rates. This indirectly can help improve customer churn by keeping customers interested in what you’re offering to them.

Developing 360 insights

Social AI can provide you with better insights after analyzing data from your customers’ online and social media activity, preferences, and buying patterns. It’s useful in monitoring and analyzing social communication, as well as guiding marketing strategy.

Improving customer support

Chatbots, despite the common perception of being “impersonal,” can actually improve the customer experience. These tools rely on AI to make recommendations, answer customer questions and predict what else they might need. What’s more - chatbots can be used 24/7, meaning customers can access support whenever they need it. The data which is captured during interactions can be analyzed and used to develop highly-personalized solutions for every customer.

Yes, AI can improve your customer churn predictions

AI and machine learning can help you better predict customer churn and give decisions makers meaningful insights into customer behavior. Of course, AI isn’t limited to predicting customer churn. Benefits such as personalization-at-scale and better customer service can help improve the customer experience as a whole. And after all, it’s a great customer experience that will truly help customers stick around.