The current global pandemic has not only forced immediate readjustments for CPG but will undoubtedly disrupt and transform supply chain business models permanently – or at least until the risk has reduced to an acceptable level – as consumers adapt to a new world of virus avoidance.

Reading the signals from a global health crisis – connecting the dots for CPG

CPG companies, small and large, have been whipsawed by this pandemic. While their initial concerns were focused primarily on supply shortages due to factory shutdowns in China, as China is bouncing back and the pandemic spread elsewhere globally, attention has quickly turned to predicting the impact on demand. How will consumers react over the lifecycle of the pandemic, and what is likely to be the new norm on the other side?

Already, new consumer behaviors are emerging as a result of a more virus-conscious, physically-distancing population. These have been broadly summed up into six behavior trends:

- Becoming increasingly accustomed to shopping online, especially for food

- Avoiding germs anywhere (more air filters at home, less salad bars in public)

- Replacing out-of-the-home services with in-home DIY capabilities (gym equipment, home office, espresso makers)

- Changing product preferences from a previous favorite to the one that can be counted on to be in stock

- Managing the initial panic-driven instinct to hoard

- Shifting to discount-driven buying in what will likely be a long economic recovery.

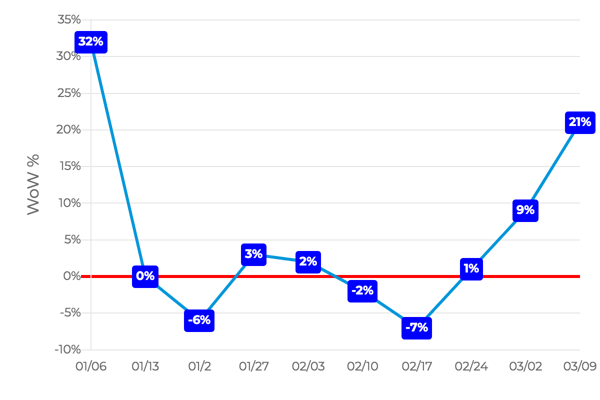

Recent Amazon data on changes in purchase behavior reflect the shift to online. In Italy, for example, week-over-week online purchases, after stabilizing following the holidays, shot up as limited quarantines began in Italy by the 23rd of February, and on March 9th, a lockdown was extended nationwide.

{Source: Sellics}

{Source: Sellics}

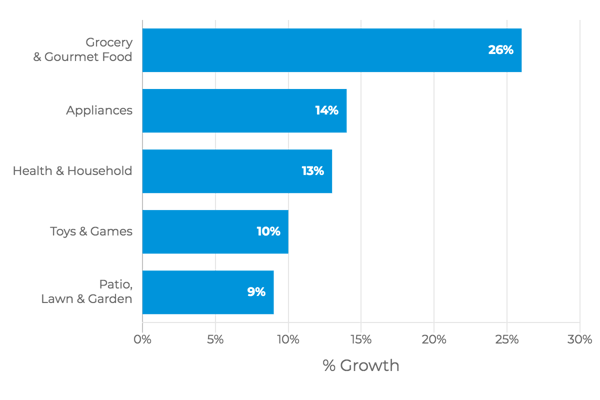

And as the US became increasingly aware of the COVID-19 threat, consumer behavior foreshadowed these shifting buying behaviors in the categories of items with highest growth in demand.

{Source: Sellics}

{Source: Sellics}

Where are the opportunities and challenges for CPG in this transformation?

If early manifestations of changes in demand behavior last beyond the resolution of this pandemic, the most dramatic transformation will be a consolidation of sales channels into fewer, more powerful online marketplaces as buyers increasingly shop on the Web while smaller retail stores, unable to command the same traffic, die away. We have already seen how Alibaba and JD.com, online marketplaces at one time limited to B2B, exploded in size following the 2003 SARs epidemic when consumers in China headed online to purchase goods.

For CPG, this presents both opportunity and challenge. Will the increasing power of online marketplaces reduce their ability to control pricing and predict end-consumer demand? Will the surge in demand for certain items be temporary or longer lasting? More importantly, can they maintain brand loyalty under the new rules of online, where aggressive CSL (customer service level) targets are dictated by the likes of Amazon? For example, because Amazon’s A9 algorithm weights recent activity more heavily, any inventory out-of-stock and lost sales could negatively impact ranking in Amazon’s search results. Keeping independent tracking of the buying signals from Amazon, and the major retailers like Walmart and Costco as they shift to more online, will be increasingly important as demand shocks resolve into temporary or permanent demand behavior.

For grocery, the digital transformation may be even more dramatic. Just 4% of grocery sales in the United States came from online in 2019, according to Nielsen, but in just 4 days of March, 2020, online order volume from full-assortment grocery merchants rose 210.1% over the same period a year earlier, according to Rakuten Intelligence. Understanding the trajectory of this growth in online grocery demand will be critical as grocers will also absorb the additional costs of picking and delivery.

Navigating the near- and long-term impacts of post-pandemic demand transformation

Just like it is challenging to discern early signals of a major marketplace disruption, so it is difficult to see the whole picture of transformation as the world emerges from a shock, like COVID-19. CPG is currently firefighting amidst a mixed bag of changing demand signals.

For one consumer electronics company, the challenge is managing demand when one major retail partner has stopped buying altogether for the next two months while, at the same time, Amazon’s online demand has surged in 100’s of percentage points. Add to that, a new challenge where, in these times when no one wants to venture out to a dentist, items like toothbrushes that have had predictable demand in the past, are flying off the shelves.

For food and beverage companies where demand has also surged, several manufacturers are practicing SKU alignment to readjust their production lines to high earner products, reducing the number of overall SKUs produced, in order to meet service levels.

Leveraging data and machine learning to survive now - and learn for tomorrow

With so many factors at play, CPG companies are now leveraging technology and data science to create response models to guide their near-term moves. Not only do these models help with biweekly or weekly category-level recommendations for items likely to experience near-term change or an offline/online shift in demand, they can also be applied to understand and react to what has just happened. For example, one major beauty products manufacturer is using models to post process forecast output due to the impact from the shut-down of a major retail partner.

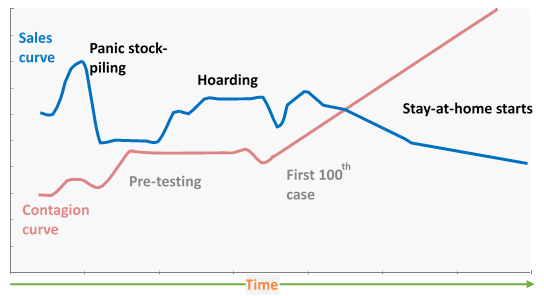

By adopting a data and machine-learning approach now, CPG companies can ensure that they are capturing the immediate learning from other regions while not overlooking key factors – such as regional and local GDP, household income, CAGR, healthcare indices, unemployment rates and population density – that might deviate demand behavior from what has occurred elsewhere. Opportunities can be found by parameterizing the contagion curve – infancy, apex and decline – and correlating it to the sales curve, by region, including China, Italy, UK, Italy, Germany and US.

Correlation between “sales curve” with the “contagion curve” to

identify level of impact at different stages of the pandemic progression.

Not actual data, for illustrative purposes only.

Most importantly, CPG companies can make quick decisions on numerous inventory supply changes with near-term, category-specific, data-driven recommendations that back up their gut instincts. In the end, data models applied now will capture the learning that is needed to foresee longer-term business transformation following the pandemic.

One thing is for sure, there will be a new normal in consumer behavior and supply chain partnerships on the other side of the Covid-19 "crisis". CPG companies need, more than ever, to apply data and machine learning to read the signals and anticipate how business will change, or risk being left behind.